See if you can get a lower insurance rate The deductible is the amount you'll pay out of your own pocket towards the expense of a car insurance coverage claim. You might be able to reduce your regular monthly premium just by raising your deductible. Still, you'll wish to believe about your total monetary situation when choosing a deductible.

Collision coverage can safeguard you if you remain in a single-car accident or get hit by another automobile or object. Comprehensive protection can secure you if your vehicle is stolen or damaged due to noncollision events like theft, natural disaster or contact with an animal. Together, these coverage options are developed to cover repairs or repay you for the worth of your car. what health insurance should i get.

If you have an older vehicle with low worth that's paid off, you hilton head timeshare may be able to get more economical coverage for comprehensive and crash, or you may have the ability to opt out of detailed and crash protection entirely what's finest for you depends upon your particular circumstance. To choose if this makes good sense for you, have a look at what's called the " book" worth of your automobile and weigh this against both the comprehensive and collision deductible and the yearly expense of this protection noted in your insurance quote.

com offer tools you can use to help estimate your cars and truck's worth. Tidy driving record? Straight-A trainee? Some insurance providers use a variety of discounts based upon group subscription, automobile functions such as anti-theft gadgets, driving history, policy ownership and more. Here are some groups that might be eligible for a discount rate, depending upon the insurance service provider.

The Ultimate Guide To How Much Does Flood Insurance Cost

However prior to you do, look into the insurance provider. A budget friendly premium is certainly crucial when choosing an insurance coverage service provider, but it shouldn't be the only factor to consider. An insurance coverage carrier that supplies fast and efficient service can make your life a lot simpler if you ever need to make a claim.

One company that offers these ratings is J.D. Power. This business conducts a yearly research study that rates insurance providers based upon several factors related to client service. You can likewise check a provider's score with the Bbb. Cost Additional info is definitely crucial when considering automobile insurance coverage, but you likewise require to ensure you've picked a trustworthy carrier and that the coverage you're getting fulfills your needs.

Credit Karma provides an easy way to shop around with various carriers. Take the time to review the details and compare them before you choose which automobile insurance plan is right for you. See if you can get a lower insurance coverage rate Warren Clarke is an author whose work has been published by Edmunds.

Sadly, there's never a year-end inventory-clearance sale on automobile insurance. However, with some deal with your part, you can still discover the most affordable auto insurance coverage rate possible. The first and best thing you can do is contrast look for automobile insurance rates from various providers. how much does an insurance agent make. You can search online estimating sites such as Compare.

See This Report about How Much Is Urgent Care Without Insurance

You might also consider contacting an independent representative for aid in getting the finest price. Independent agents normally offer policies for 5 to eight insurer therefore can select from a number of choices to identify exit timeshare reviews what is finest for you. how to shop for health insurance. Recommendations from loved ones members might also be helpful in limiting your choices, particularly when it pertains to the integrity of an insurance agent or company.

The bottom line: You should compare rates from at least 3 business prior to deciding on one. Ensure that any website or individual you provide personal info toespecially details of a financial natureis trustworthy. Policies grouped together and bought from the same insurance provider are generally less expensive than different policies from different business.

And you can also add an umbrella policy, which secures you from liability beyond what your property owner's or vehicle policy covers and is likewise referred to as excess liability insurance coverage. Since March 2020, Farmers provided the best bundling discount for house and automobile policies, at 22. 05%. However USAA was still cheapest total among 8 insurers, even with its smaller sized, 3.

Automobile insurer provide a large variety of discount rates based on devices that is installed on your automobile and your loyalty as a consumer, among other elements. You ought to ask for all that apply to you, and validate that your expense reflects them. For example, Geico uses a 40% discount rate if your automobile has a full-front-seat air bag and a 25% discount rate if you insure more than one car on a policy.

The Basic Principles Of Why Is My Car Insurance So High

In every state other than New Hampshire, chauffeurs are needed to have a minimum quantity of liability insurance, which covers you for any damage you do to another driver's vehicle and for any injury to that chauffeur. Consumer Reports recommends drivers to go beyond these state minimums and purchase liability insurance that covers $100,000 per person, $300,000 per event, and $100,000 for residential or commercial property damage.

Accident protection is for damage to your own vehicle if you have an accident including another automobile or a things, such as a telephone pole. Comprehensive coverage safeguards you from a non-collision-related loss, such as theft, vandalism, or damage triggered by bad weather condition, a falling item, or an animal. Consumer Reports suggests canceling C&C coverage if the annual premiums for it total up to 10 percent or more of your car's book value.

( A deductible is the amount of money you consent to pay prior to your insurance company will make any payment toward your own loss.) Nevertheless, C&C coverage does have a deductible. The larger the deductible quantity you consent to pay, the lower your insurance coverage premiums will be. Customer Reports recommends canceling your C&C coverage if the premiums for it amount to 10 percent or more of your car's book worth.

If you opt for the greater deductible to save money on premiums, consider keeping your deductible amount in a savings account so you will be prepared in case you require to submit a C&C claim. If you do not drive many miles and are a cautious driver, you could conserve some cash with pay-per-mile (PPM) or telematics insurance.

How Much Does A Doctor Visit Cost Without Insurance Fundamentals Explained

Both companies use gadgets in your vehicle to track the number of miles you drive annually. When it comes to Esurance, if you drive less than 10,000 miles, your premiums will be less. Esurance's PPM program isn't readily available in all states or for hybrid or electrical lorries. A number of significant insurance provider go a bit farther and utilize a telematics gadget to track your driving habits, consisting of jamming on the brakes, speeding, and driving after dark.

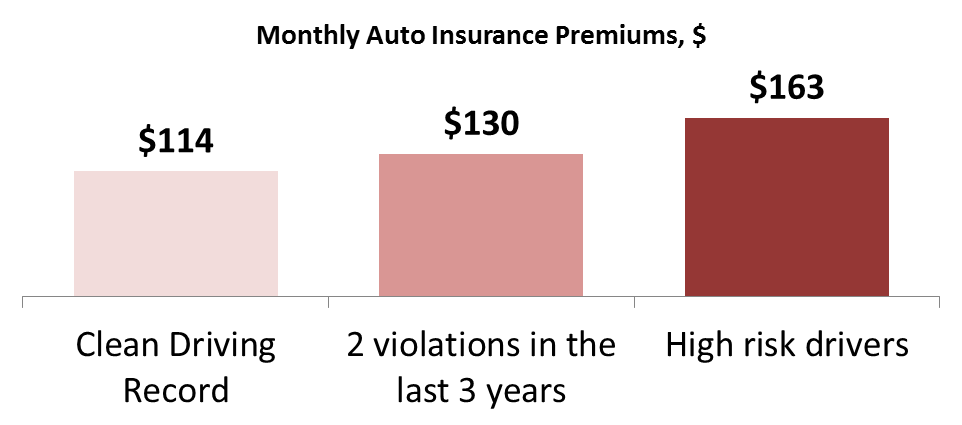

Safe motorists get some of the best rates, so getting the most inexpensive rate possible can result straight from your own actions. The major vehicle insurance coverage business have various requirements for what exactly makes up a safe driving record however not having been ticketed for a moving violation or not triggering a mishap are standard.