Health insurance coverage is available for purchase through many various services and suppliers. From private care to public options, there are various types of medical insurance to select from. The most inexpensive medical insurance choice is to register in the federal Medicaid program, but eligibility depends on the state you live in, as well as your income level.

On this exchange, you can browse for and compare inexpensive medical insurance plans from numerous companies. For people who are qualified, the cheapest health insurance coverage alternative is Medicaid. In order to be qualified in the federal insurance program, your family earnings must be less than either 133% or 138% of the federal hardship level (FPL).

For those who are not eligible for Medicaid coverage, the least expensive health insurance coverage with complete medical benefits is individual coverage, which can be acquired through your state market. Complete benefits mean that these medical insurance plans offer comprehensive coverage for all 10 of the necessary health benefits required to be covered under the Affordable Care Act.

Instead, the most economical alternative is the policy that supplies the ideal amount of medical insurance coverage depending upon your medical requirements and health at your finest rate. We compared specific medical insurance plans provided on all state medical insurance markets to recognize the lowest-cost option at each level of protection.

Bronze metal tier medical insurance policies are the least expensive available on state health insurance marketplaces. Although they have the most affordable premiums, the deductibles and out-of-pocket optimums are higher than for the other tiers. For this reason, if you anticipate to have big medical expenditures in the coming year, we do not suggest a Bronze policy - how to get therapy without insurance.

This is an even lower-cost market medical insurance alternative that is only available if you are under 30 years old or have a hardship exemption. Silver medical insurance policies are middle-ground strategies that have modest premiums, deductibles and out-of-pocket optimums. For many low-income families, a Silver plan is the most inexpensive medical insurance due to cost-sharing decreases, which permit eligible individuals to get reductions on the amount they pay in premiums, deductibles and out-of-pocket maximums.

This can minimize premiums substantially and make the Silver prepare an excellent choice for lots of households. Gold health insurance strategies are frequently the most expensive that you can purchase on your state market. Nevertheless, Gold plans have the most affordable deductibles and out-of-pocket optimums. For this reason, a Gold medical insurance policy can help you conserve cash if you anticipate high medical expenses during the strategy year.

What Does How Much Does A Dental Bridge Cost With Insurance Mean?

If you expect high medical expenses, you might also want to think about Platinum medical insurance. Platinum policies have fairly pricey premiums, however also the most inexpensive deductibles regularly $0. However, these plans are not readily available in all states. The very best economical medical insurance policy for you is a plan that provides sufficient health protection for you and your family.

We recommend starting your search by taking a look deedback at a Silver health insurance policy if you are buying coverage from your medical insurance market. As discussed above, these strategies have modest premiums with minimal out-of-pocket expenditures in case you or an enjoyed one gets sick or injured. Moreover, the Silver policy deductibles are normally lower and much easier to reach.

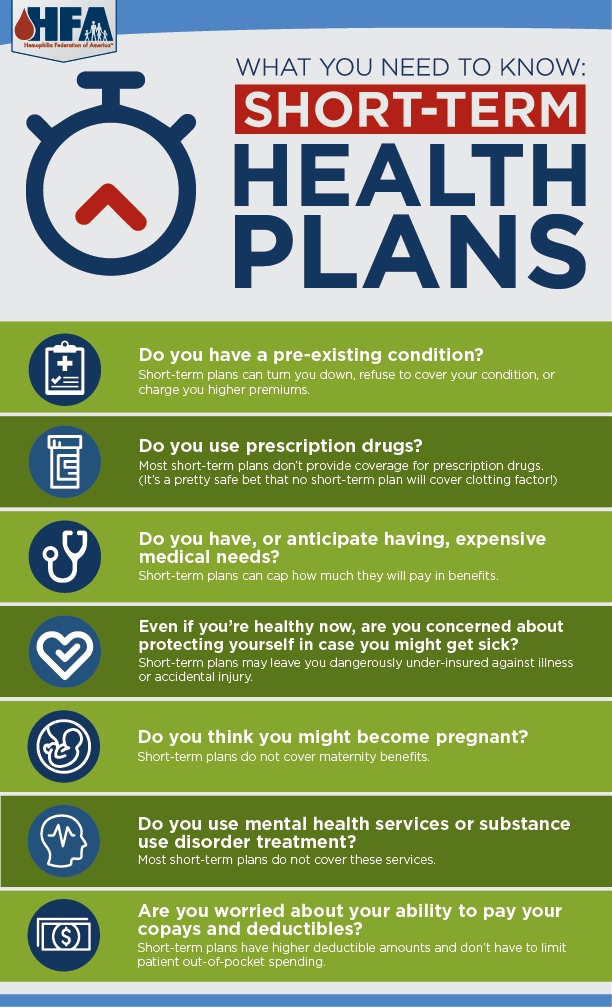

The most affordable choice is to enlist in Medicaid if your earnings falls listed below 138% of the federal poverty level. This is a federally financed medical insurance program that offers health benefits to low-income individuals. For those not qualified for this alternative, the most cost effective service might be through your state market, along with off-exchange plans, including short-term health insurance coverage policies.

Therefore, to discover the finest value protection, you need to examine your medical needs before purchasing a medical insurance policy. is more affordable than marketplace healthcare. These strategies have low-priced monthly premiums, but the policies may only extend a couple of months approximately one year at a lot of, depending on short-term medical insurance laws in your state. how long does an accident stay on your insurance.

These health policies usually will not cover all of the vital health advantages covered under the Affordable Care Act insurance coverage discovered on your state marketplace. Students typically have extra medical insurance alternatives. Lots of universities and colleges exit timeshares offer free health insurance to students through how to get out of a timeshare loan a school-sponsored strategy. These policies usually supply health insurance coverage for many on-campus medical services, but you may lose the coverage if you end up being a part-time trainee or transfer schools.

These health insurance policies are designed for full-time students between the ages of 17 and 29. Plans can be purchased through a lot of big medical insurance business and are paid either by an annual or semiannual premium. A trainee health strategy can be a fantastic inexpensive medical insurance coverage alternative since you will not lose your coverage if you decide to transfer to a different school.

Nevertheless, these suppliers might not use policies with as numerous advantages as other strategies. This is an essential aspect to assess when looking for the for your family. For instance, our analysis found that in nine states, the least expensive health insurance coverage company that provides Silver market health insurance coverage is Blue Cross Blue Guard (BCBS). how to get insurance to pay for water damage.

Unknown Facts About How To Get Cheaper Car Insurance

Compare available health insurance state to state. Discover your state listed below and get information about medical insurance provider and items offered there, then get a quick, free health insurance coverage quote. The chart above reflects both significant medical (Obamacare) and short-term (non-Obamacare) medical insurance plans based upon the information on our platform.

Not all plans within a state are offered in all areas of the state or to all citizens in that state. Health insurance coverage premiums are filed with and regulated by your state's Department of Insurance. Whether you buy from eHealthInsurance, your regional representative, or directly from the health insurance business, you'll pay the very same regular monthly premium for the same strategy.

eHealthInsurance is the country's leading online source of health insurance. eHealthInsurance offers thousands of underwritten by more than 180 of the country's medical insurance companies, including and Blue Cross Blue Shield. Compare strategies side by side, get health insurance coverage prices quote, apply online and discover today.

Open Enrollment is over. You can still get 2021 health insurance coverage 2 methods: Begin highlighted text Provide some earnings and household information to see strategies readily available in your area, with estimated rates based on your income. End highlighted text.

Self-employed individuals and those who do not get protection through work can purchase health insurance coverage intends on the market, produced during the Obama administration under the Affordable Care Act. You can just purchase a strategy throughout a registration period. For 2021 health protection you can shop during open registration November 1, 2020, to December 15, 2020.

You can find out more about how to get Obamacare on the federal health insurance marketplace site. Medical insurance helps pay for medical expenses. But it isn't free. That's why it is necessary to understand just how much you can pay for to spend on health insurance on a yearly basis. The first expense in medical insurance is the premium.